It offers stability and predictability, helping to cover living expenses. It can act as a hedge against inflation, maintaining purchasing power. Reinvesting income allows for long-term wealth building.

It offers flexibility with various investment options.

Here are 7 easy ways to generate income through investing:

It’s important to note that investing involves risks, and returns are not guaranteed. Before investing, it’s recommended to conduct thorough research, consider your risk tolerance, and seek advice from a financial professional.

1. Dividend stocks:

Are a popular income investing option because they offer both potential capital appreciation and regular dividend payments. Dividends can be reinvested or used as a source of income. Companies with a consistent dividend track record demonstrate stability and financial health.

Dividend payments are often seen as a sign of a company’s profitability and commitment to shareholders. Dividend stocks can provide a reliable and passive income stream, making them attractive for investors seeking regular cash flow.

2. Bonds:

Bonds are considered a safer income investing option compared to stocks, as they offer fixed interest payments and return of principal. Government bonds are generally more secure than corporate bonds but may have lower yields. Corporate bonds carry slightly higher risk but can provide higher yields.

Bond investing allows diversification and income stability as interest payments are typically reliable. Bonds can be held until maturity or traded in the secondary market for potential capital gains. Overall, bonds provide a predictable income stream and can be suitable for conservative investors seeking stability and regular income.

3. Real Estate Investment Trusts (REITs):

REITs offer the opportunity to invest in real estate without the need for direct property ownership. They provide access to a diversified portfolio of properties across various sectors like residential, commercial, or industrial.

REITs generate income through rental payments and property appreciation, and they are required by law to distribute a substantial portion of their profits as dividends, making them an attractive option for income investors seeking exposure to the real estate market.

4. Peer-to-Peer Lending:

Peer-to-peer lending platforms connect borrowers directly with investors, eliminating the need for traditional financial institutions. By lending money through these platforms, investors can earn interest on their loans, potentially generating a steady stream of income.

It allows individuals to diversify their investment portfolio and support borrowers in need while earning attractive returns. However, it’s important to carefully assess the risks involved and choose reputable platforms with proper risk management measures in place.

5. High-Yield Savings Accounts:

Opening a high-yield savings account provides a safe and convenient way to earn income on your savings. These accounts typically offer higher interest rates than traditional savings accounts, helping your money grow faster.

With easy access to funds and the potential for compounding interest, high-yield savings accounts are a reliable option for earning passive income while preserving liquidity.

6. Annuities:

Annuities offer a reliable source of income by converting a lump sum of money into a stream of payments. They provide financial stability and can be customized to fit your specific needs, whether it’s a fixed or variable annuity.

With annuities, you can secure a steady income stream for retirement or other long-term financial goals.

7. Rental Properties:

Investing in real estate properties allows you to earn passive income through rental payments, providing long-term cash flow. It offers the potential for property value appreciation, resulting in capital gains when selling.

Real estate investing provides diversification and a tangible asset that can generate income and wealth over time.

Income investing can be beneficial for several reasons:

1. Regular Income Stream: Income investing focuses on generating regular income from investments. This can be particularly attractive for individuals who rely on investment income to cover their living expenses or supplement their earnings.

2. Diversification: Income investments often span a range of asset classes such as stocks, bonds, real estate, and more. By diversifying your investment portfolio, you can spread the risk and potentially achieve more stable income streams.

3. Stability and Predictability: Many income investments, such as dividend stocks or bonds, provide a predictable income stream. This stability can offer peace of mind, especially for investors seeking a reliable source of income.

4. Inflation Hedge: Certain income investments, such as inflation-protected bonds or dividend stocks, have the potential to outpace inflation. This means that your income has a higher chance of maintaining its purchasing power over time.

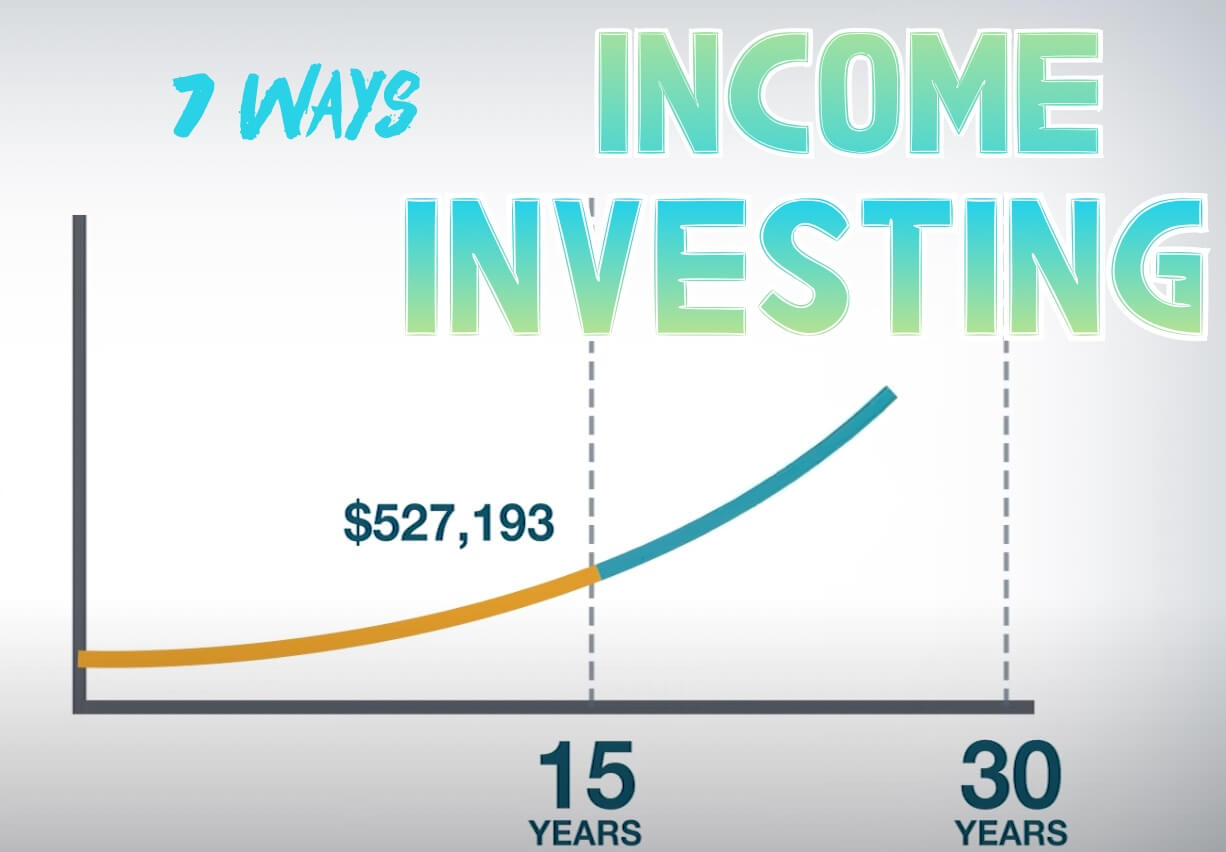

5. Long-Term Wealth Building: Reinvesting income generated from investments can compound your returns over the long term. By consistently reinvesting income, you can potentially grow your investment portfolio and increase your income over time.

6. Flexibility: Income investing offers flexibility in terms of investment options. There are various income-generating assets available, allowing investors to choose investments that align with their financial goals, risk tolerance, and time horizon.

However, it’s essential to consider the potential risks and drawbacks of income investing, such as market fluctuations, interest rate changes, and specific risks associated with different investment types.

Conducting thorough research, diversifying your portfolio, and seeking professional advice can help mitigate these risks and maximize the benefits of income investing.